OUR MISSION

Provide our pool of investors access to the growing tech startup ecosystem aiming to reach the best investment returns by supporting entrepreneurs' innovative solutions with financial and intellectual capital with a long-term view, enabling them to sustainably build out their business.

CONCEPT

We are born from our network and we believe that the collaboration of many different people's skills and connections with diverse points of view to build fast great companies. We are entrepreneurs talking with entrepreneurs.

We like great businesses that are addressing the real needs of LATAM and the U.S markets.

We invest in intelligent and resilient founders that spend all their time and energy solving their business’ core issues. We listen to help to create value.

We engage our network to quickly generate the maximum impact in sales, focusing on growth to be a global company.

We foster a balance between capital commitment and intellectual contribution, seeking to reach the next funding round in the U.S.

Our commitment

- Provide resources to accelerate growth, consolidate business plan execution for a next round investment window.

- Partners’ focus (as advisors and/or Board Members), targeting value creation through required business model adjustments.

- Two-way route where Investors get educated on the principles of investing in startups while giving back by providing access to combined sector knowledge and relationships.

INVESTMENT THESIS

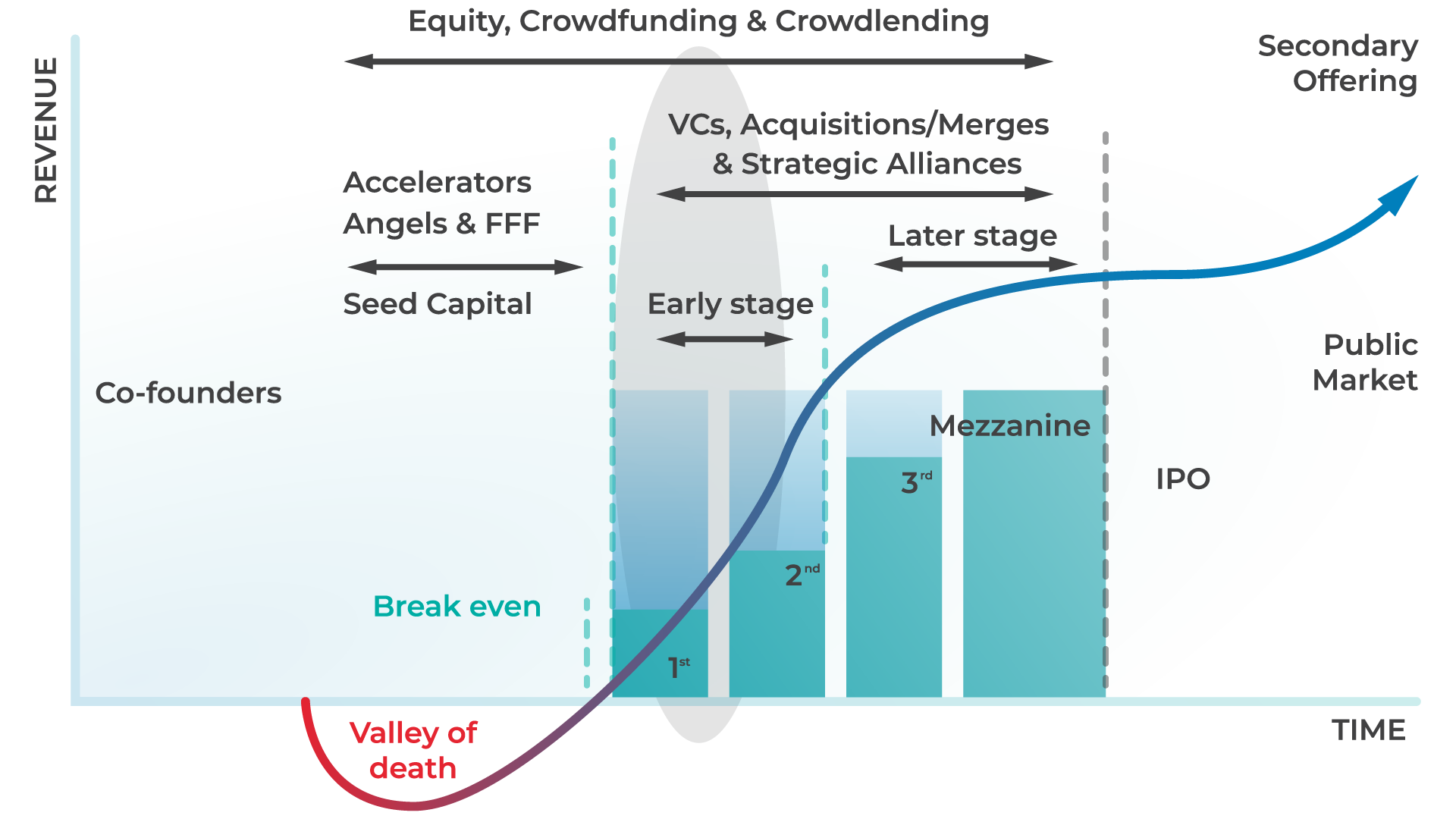

We are expert investors in the best B2B startups in Seed/Series A/B stage with potential to enter the American market. We make primary and secondary investments. We source our deals within our extensive network built up over the last few years, and through our professional life. We know the business and seek to safely multiply investment, as we focus on startups that are already operational and have a robust execution model. We look for a focus on vision and business, product and its usability, data and processes, with technology as the critical business underlying fabric.

- Late seed stage sweet spot reducing the ”valley of death risk” while producing the type of returns we see, Seed, Series A, Series B and Secondaries;

- Target participation of 10% for board seat and/ or advisory role;

- Average ticket ~US$2.5MM per investment;

- Innovative SaaS based solution targeted at enterprise clients for an identified problem that can create impactful and immediate results;

- Subscription weighted revenue stream with limited capex;

- Tested product & business model geared towards classic B2B with a relatively low customer acquisition cost;

- Inspiring and engaged founders with capability to set up winning teams and face challenges;

- Business model that can be replicated in new geographies and markets;

GROWTH THESIS

Risk return relation compatible with proposed timing to enter and exit the company

OUR TEAM

Comprised of experienced professionals with roles based on profile and background

We are a fund with a leading group that works closely with an extremely exclusive network of entrepreneurs and executives of large enterprises with access to capital that understand our investment selection thesis and demonstrated interest to participate in fundraising.

Our team, led by Geraldo Neto, started to use this business model in 2012 with 40 investors. The GAA Investments in Florida was created in early 2017 with just 12 investors..

In only 5 years, GAA portfolio grew to 14 companies, attracting more than 140 investors, achieving an IRR above 50% pa, with 1 unicorn and 5 Series A rounds. We forecast the other 9 companies to go for series A in 2022 and 2023.

And now, with the experience of other entrepreneurs bringing much more depth to what to look for in a startup, we launch the Staged Ventures Investments.

With Flávio Pripas, ex-head of Cubo Itaú in Brazil, Investor at Redpoint eventures Brazil, one of the main VCs, Camila Farani, Shark Tank Brasil, LinkedIn influencer Top Voice, Douglas, and Daniel Almeida, publicists and media specialists, founders of Stayfilm, a Brazilian fundraising case.

Together, we are constantly looking for opportunities in Brazil and LATAM, focused on the thesis of startups with global B2B solutions, interested in Cross Border strategy.

Geraldo Neto

Founder and General Partner Executive at Staged Ventures

Weston, FL

Geraldo Neto is an entrepreneur with more than 30 years experience in various verticals such as civil construction, international trade, retail and technology.

He has also been an angel investor since 2002 in Brazil, as one of the leaders at Gavea Angels, the first organization of angel investors in Brazil.

Geraldo is a Founder of GAA Investments, and Board Member several companies.

Flávio Pripas

investor at redpoint venture capital brazil, general partner at staged ventures

Fort Lauderdale, FL

Flavio Pripas, a seasoned executive with a proven ability to execute, with 2 exits, who was head of Cubo in Brazil, Investor at Redpoint eVentures and currently CSO of Digibee.

Camila Farani

Partner G2 Capital

and Venture Partner

at Staged Ventures

Rio de Janeiro, RJ

Camila is is an investor in the Brazilian version of Shark Tank, CEO of G2 Capital, an investment focused on tech startups, is a Board Member of Gavea Angels, Modal Bank, Nuvem Shop and PicPay.

Camila is highly recognized and respected in the Brazilian and international startup community and acts as a special strategic advisor to GAA Investments.

TEAM - BOARD MEMBER

TEAM - ADVISORS

PORTFOLIO

OUR PORTFOLIO

Our customers experience digital transformation up to 70% faster with less cost. Digibee's eiPaaS enables system integrations for IT leaders at the largest companies around the world. Whether its data integration, legacy system integration, or cloud migrations, we lead our customers to more successful and efficient solutions.

Leveraging cutting-edge industry insights, Inyo’s solution is not only robust but is also meticulously designed with compliance in mind. It's primed to support diverse use cases, catering to everyone from Fintechs, Banks, to Insurance and remittance players who wants to join global payments..

PARTNERS' PORTFOLIO

CONTACT US

Submit your deck to

For other matters to

Mailing Address:

P.O. BOX 268597 - Address: 1870 N Corporate Lakes Blvd.

Weston, FL 33326

pipeline@staged.ventures

Disclaimer

BIG4 Investments and Staged Ventures. For the purpose of this presentation, any reference to the name BIG4 and or Staged Ventures means ‘BIG4 Investments’ specific business, except otherwise mentioned.

Presentation. Not an Offer to Sell; Qualified by Private Information Deck. This important legal information is an integral part of this presentation. This document shall not constitute an offer to sell or the solicitation of an offer to buy which may be made only at the time a qualified offeree receives a Private Information Deck describing the offering and related subscription agreement for specific Investment. All information contained herein is qualified in its entirety by information contained in any Private Information Deck. An investor should consider Investment Opportunity characteristics, objectives, risks, costs and expenses carefully before investing. This and other important information about the Investment can be found in the Private Information Deck provided to all Investors. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision. All details and information related toa specific Private Information Deck were provided by each referred Company.

Regulatory Status. BIG4 Investment Clubs will not be registered under the Investment Company Act of 1940, as amended, in reliance on an exception thereunder for private funds. Interests in the SPV formed to carry the investments will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state and will be offered and sold in reliance on exemptions from the registration requirements of the Securities Act and such laws.

Investment Club Entail Risks. Investment Clubs are speculative investments and are not suitable for all investors, nor do they represent a complete investment program. An investment in any specific project will be available only to qualified investors who are comfortable with the substantial risks associated with investing though Investment Clubs, and the potential to lose all or a substantial amount of the investor’s investment. Investing Startup or Early-Stage Companies present specific risks inherent to any initial business development opportunity. There can be no assurance that an investment strategy will be successful.

Projections May Not Materialize. The information in this presentation may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. Projections are based on a statistical analysis of historical information. There is no guarantee that projections will be realized or achieved, and they may be significantly different than that shown here. Investors should keep in mind that the Startup market is unpredictable. There are no guarantees that the historical performance of a company will have a direct correlation with its future performance. The information in this presentation is a speculation of what the valuation of a strategic invested company may reach in future, subject to all the constraints any business may face in its execution.

Confidentiality. This document is being delivered to a limited number of prospective accredited investors who may be interested in investing though Investment Club. By your acceptance of this document, you agree that (a) neither you nor your agents, representatives, or employees will copy, reproduce, or distribute this document to others, in whole or in part, at any time without the prior written consent of BIG4, (b) you will keep permanently confidential all information contained in the document not already in the public domain, and (c) you will use this document for the sole purpose of evaluating an investment though Investment Club. If you are not prepared to accept the document on this basis, please return it immediately to BIG4.

Smart Capital accelerating disruptive companies

Our offices:

US: 299 Alhambra Circle - Suite 403 - Coral Gables, FL 33134

Brazil: R. Arizona, 491 - 23rd floor - Cidade Monções, São Paulo - SP, 045667-001